do you pay california state taxes if you live in nevada

Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those services. By Gabrielle Olya Aug 19 2018 Taxes 101.

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations States In America

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada.

. By simulating a move to Nevada from California we find that Bob and Jane save over 156000 in taxes throughout their retirement. Do you pay california state taxes if you live in nevada. Colorado has a flat-rate tax of 463 for most gamblers.

Social Security retirement benefits are exempt but California has some of the highest sales taxes in the US. Thats due to the source rule. Click to see full answer.

I moved from Illinois to Nevada June 30 th. This gambling tax by state depends on the type of gambling for example the gambling winnings state taxes 10 on sportsbooks winnings. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada.

As a part-year resident you pay tax on. You will want to file the non-resident first and then your Nevada state return so that your state return can be calculated correctly against any credit from the non-resident CA state return. In fact even if you live somewhere else you might have heard of.

Can the state of California tax me on wages if I lived in Nevada all year. The state of California requires residents to pay personal income taxes but Nevada does not. Do I pay California income tax if I live in Nevada.

34 Votes It depends. Income from California sources while you were a nonresident. All worldwide income received while a California resident.

If you lived inside or outside of California during the tax year you may be a part-year resident. The state of California requires residents to pay personal income taxes but Nevada does not. While federal law prevents California and other states from taxing pension income of non-residents you may have to pay taxes on this income to.

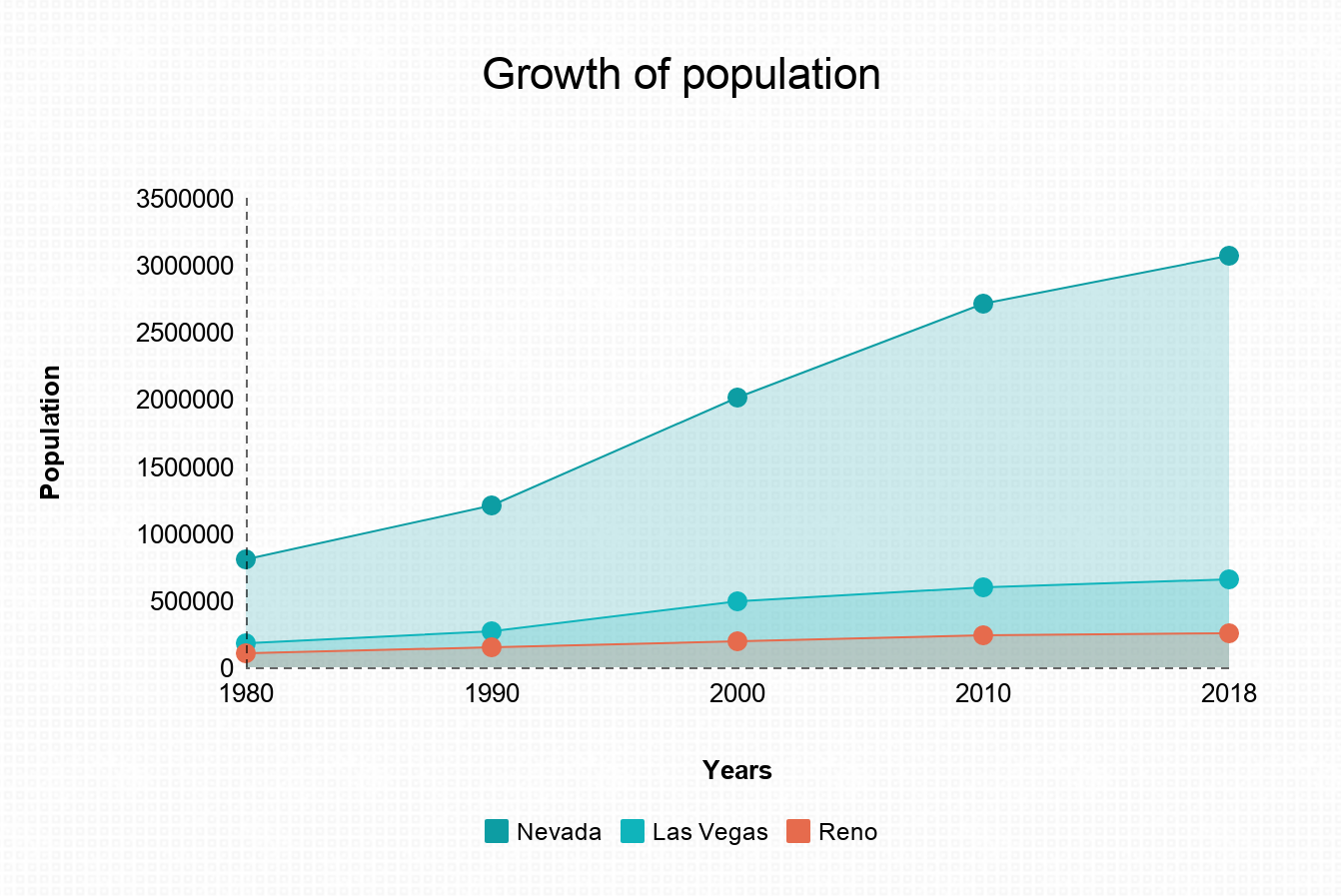

Taxpayers in Nevada must pay a larger percentage of their income than the average American. However this rate does not include an additional 1 surcharge for tax payers with incomes over 1 million per year making their top marginal tax. This is enough to get them a little over one extra year of income.

Colorado is considered on the lower end of the scale with gambling tax by state with most taxes remaining at the flat rate of 463. In California partnership LLCs pay a tax ranging from 1700 to almost 12000 per year depending on the net taxable income of the entity. All worldwide income received while a.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. Californias Franchise Tax Board administers the states income tax program. If you live in California you probably know how aggressive Californias state tax agency can be.

For instance if you live in California and you have 1500000 in taxable income your state income tax bill comes out to approximately 175921. If your work state is not on this list check out the next section this exemption form will relieve you of the burden of paying income taxes to the state in which you work so you only need to pay taxes to the state in which you live. In California S-corporations are taxed at a rate of 15 on the net taxable income with the minimum tax being 800.

Furthermore below you can see a year-by-year breakdown of Bob and Janes estimated taxes. However even though you do not live in California you still must pay tax on income earned in California as a nonresident. It is true that in nevada you do not pay tax on that income but california can tax you.

If you move from California to Nevada this seems to avoid California state taxes in many instances. Do I have to pay California taxes if I live out of state. Say however you If you move from California to Nevada this seems to avoid Tax professional.

Yes you need to file a non-resident state return for the California income. I moved from Illinois to Nevada June Tax professional. That amount accounts for federal income taxes state income taxes sales.

As a part-year resident you pay tax on. You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like Nevada. If you move to Nevada Texas or one of the other states without an income tax that money goes straight back into your pocket.

If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of company do I have to pay California state taxes for 365 days or for just 65 days. Therefore depending on your total income you may have made enough money in California for them to have taxed you through the year. The second rule is that California will tax income generated in the state regardless of where you live.

Or is the california tax prorated based on the number of months you lived in california. Generally if you work in california whether youre a resident or not you have to pay income taxes on the wages you earn for those services. In Nevada there is no income tax imposed.

It is true that in Nevada you do not pay tax on that income but California can tax you. California taxes all taxable income with a source in California regardless of the taxpayers residency. In Nevada there is no income tax imposed on S-corporations.

I have no income in Illinois for 2021. While tourists come to Nevada to gamble and experience Las Vegas residents pay no personal income tax and the state offers no corporate tax no franchise tax and no inventory tax. 395 268 Views.

Californias Franchise Tax Board administers the states income tax program. California is notorious for having the highest state income tax bracket in the nation with a top marginal income rate tax of 123. The state of California requires residents to pay personal income taxes but Nevada does not.

However even though you do not live in California you still must pay tax on income earned in California as a nonresident. California Tax Rules For Remote Employees. It is true that in Nevada you do not pay tax on that income but California can tax you.

Do you pay California state taxes if you live in Nevada. Taxes on the sale of a 1000000 in ca is 12500. Californias Franchise Tax Board administers the states income tax program.

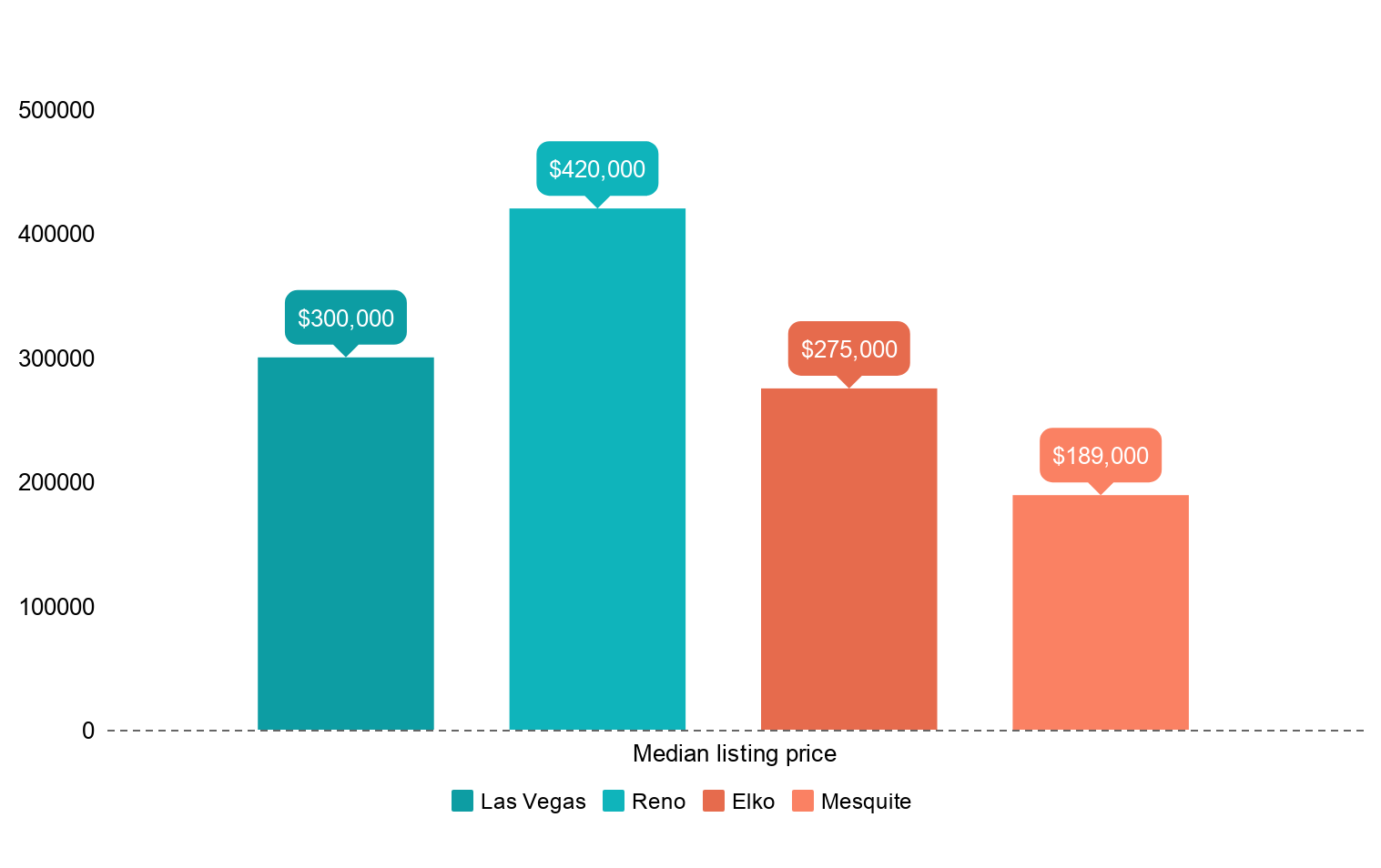

A 2018 GOBankingRates study found that the average Nevada resident will pay over 11000 in taxes each year or about 21 percent of their annual earnings. The Silver State does have a 685 sales tax and also collects fees most of them related to those casinos the tourists flock to. Below is a summary of state tax rates in Nevada compared to California.

The state of California requires residents to pay personal income taxes but Nevada does not.

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Google Image Result For Http Www Arialasvegas Com Sites Default Files Styles 1280x672 Public Amenities Tours Sky Nevada Travel Travel Usa Lakes In California

Moving To Nevada From California Retirebetternow Com

Nevada Vs California Taxes Retirepedia

Nevada Vs California Taxes Explained Retirebetternow Com

Pros And Cons Of Moving To Nevada From California

Pros And Cons Of Moving To Nevada From California

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest

Pros And Cons Of Moving To Nevada From California

Nevada Vs California Taxes Retirepedia

Nevada Vs California Taxes Retirepedia

Felix Reports After 30 Years In La Canyon Partners Plans Move T California Sign California San Bernardino County

50 And 50 News Kansas Missouri Best Cities The Unit

Pros And Cons Of Moving To Nevada From California

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income Best Places To Retire Retirement Locations

Moving From California To Nevada Or Arizona Which Is Better Rpa Wealth Management

Nevada The New California The Nevada Independent

Ahrq Logo Comparison Of The 50 States And The District Of Columbia Across All Health Care Qua Healthcare Education Health Care Social Determinants Of Health

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)